Markets Brief: Jobs Report, Powell Just Made the Outlook a Lot More Uncertain

Chinese EV stocks Li Auto, Nio, and XPeng make a comeback. U.S. retailers show signs of slowing sales.

The past week ended on a whimper, with a big Wednesday rally borne of optimism about a potentially less hawkish Federal Reserve colliding with a jobs report that raised concerns about just how fast inflation pressures will be able to abate.

As investors continue to debate whether or not bear-market lows are in for stocks, or if bond yields can continue to head lower, the biggest question continues to be those two variables: How much will inflation come down and what that means for Fed policy.

The news and economic data calendar is particularly light this week, meaning investors will have plenty of time chew on those two unknowns following Fed Chair Jerome Powell’s most recent comments. When Powell spoke last Wednesday, he confirmed market expectations that when the Fed meets next week they’ll moderate the pace of interest rate increases.

That news cheered investors, helping lift stocks to extend the rally to nearly 14% above the most recent bear-market low.

But in his talk, which was focused on the intersection between inflation and the labor market, Powell made it clear there are considerable unknowns ahead. (Investors would do well to read Powell’s actual remarks or watch the video). “The truth is that the path ahead for inflation remains highly uncertain,” he said.

Then came the November jobs report. As we wrote about last week, two of the most important data points to watch were wages and data around the size of the labor force. There’s a close connection between the two, with a smaller labor force following the pandemic likely contributing to upward pressure on wages.

Economists were hoping that at the very least, the November jobs report would confirm recent data showing a slowing of upward pressure on wages.

It didn’t. In fact, revisions to the previous month’s data erased what had been a softening of wage pressures.

Earnings Data Changes the Inflation Outlook Contour

“Average hourly earnings had seen some cooling under the hood,” says Jonathan Pingle, chief U.S. economist at UBS. Prior to Friday’s report, the three-month average annualized change in earnings had slipped to 3.9% as of the October report, but that was revised significantly higher to 4.7% with the latest data. Worse, November clocked in at a very hot 5.8%.

“From the Fed’s perspective, the discomfort is going to be average hourly earnings,” he says. “If they don’t slow, that’s where you risk a wage-price feedback loop, especially through services prices in the inflation basket that are particularly sensitive to wages.”

Broadly, “the labor market is starting to come back into balance,” Pingle says. “If it weren’t for the average hourly earnings data, if they had slowed in line with had been expected, this would have been a report the Fed wanted to see. But the earnings data changed the contour.”

The wages data gained even more importance following Powell’s remarks, notes Erik Weisman, chief economist and a portfolio manager at MFS Investment Management.

Powell singled out an inflation measure known as core services other than housing as perhaps, “the most important category for understanding the future evolution of core inflation.”

Powell in a Corner

With that, Weisman says, “Powell has backed himself into a bit of a corner.” That’s because “if the labor market is strong, core services ex-housing inflation is going to remain very sticky.” This category alone could make the difference between inflation merely heading lower next year and getting down to the 2% inflation target the Fed is trying to reach, Weisman says.

Against this backdrop, Weisman sees more uncertainty in the outlook than many investors appear to be factoring in. Markets are expecting the Fed to stop raising rates by spring, but “a lot is going to happen between now and (the March 3 Fed meeting),” he says. “It wouldn’t be unreasonable for the Fed to say we should be pausing here,” but at the same time, that wouldn’t necessarily mean that the next move from the Fed would be to lower rates if inflation doesn’t come down, he says.

Meanwhile, he says, long-term bond yields aren’t priced for a recession, with a U.S. Treasury 10-year yield at 3.5%. “If you think we’re going to have a recession, then 10-year bond yields should be lower,” he says.

At UBS, Pingle says they are currently expecting the U.S. economy to slide into a recession. “The economy currently has some momentum, but we’re expecting that to wane substantially after the turn of the year,” he says. Pingle says that the current pace of consumer spending, which has been a big reason for continued economic growth, will fade.

“By the middle of next year, around the second quarter, the impact of higher rates, on top of low savings rates and too elevated consumption, will start to bite and we expect to see an outright contraction in the latter three quarters of next year,” he says. In addition, in the first half of the year, inflation should continue to move lower.

But between now and then, Pingle says the Fed will continue to raise interest rates, taking the federal-funds rate target to roughly the 4.75%-5% range from its current target of 3.75%-4%. At that higher level, “we think that is restrictive.” And then once the economy shows visible signs of recession, the Fed will start to shift gears. “If we do start to get outright job losses, the Fed won’t just sit on their hands,” he says.

Events scheduled for the coming week include:

- Tuesday: AutoZone (AZO), and MongoDB (MDB) report earnings.

- Wednesday: Campbell Soup (CPB), and Toll Brothers (TOL) report earnings.

- Thursday: Broadcom (AVGO), Costco Wholesale (COST), and DocuSign (DOCU) report earnings.

- Friday: Producer Price Index report for November.

For the trading week ended Dec. 2:

- The Morningstar US Market Index rose 1.19%.

- The best-performing sectors were communication services, which rose 2.93%, and consumer cyclical, up 2.34%.

- The worst-performing sector was energy, which fell 1.97%.

- Yields on the U.S. 10-year Treasury fell to 3.51% from 3.69%.

- West Texas Intermediate crude oil prices rose 4.85% to $79.88 per barrel.

- Of the 841 U.S.-listed companies covered by Morningstar, 585, or 70%, were up, and 256, or 30%, declined.

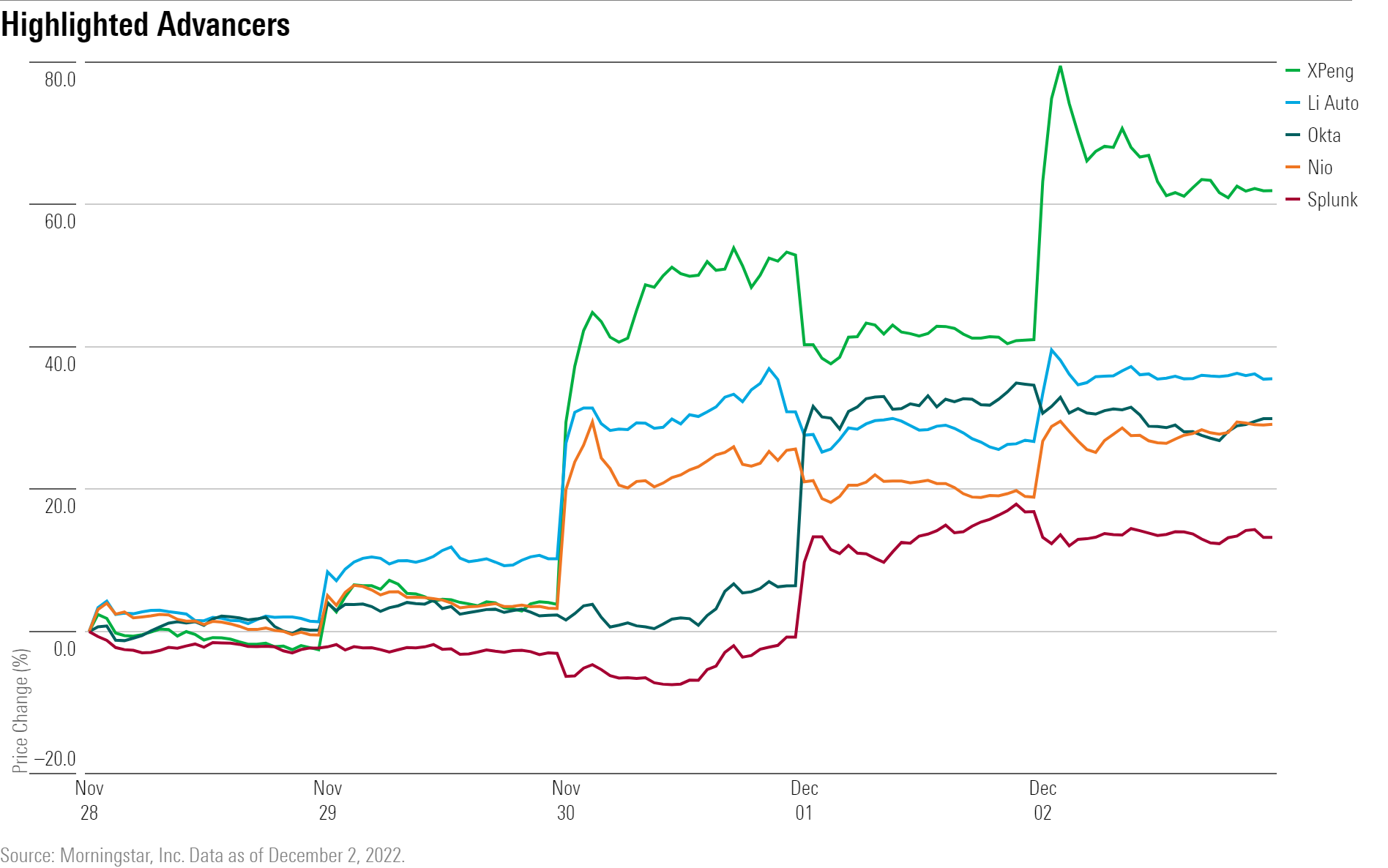

What Stocks Are Up?

China-based electric vehicle makers saw their stocks rally as November delivery data showed a resurgence of demand. Li Auto (LI) and Nio (NIO) achieved record-high monthly deliveries in November. Li Auto delivered 15,034 vehicles versus 10,052 in October, while Nio delivered 14,178 vs. 10,059. XPeng (XPEV) also showed an increase in vehicle deliveries, up to 5,811 in November from 5,101 in October, and is up 33% year over year.

Earnings results from Okta (OKTA), a cybersecurity software provider, and Splunk (SPLK), a software firm specializing in search technologies, rose after both companies reported revenue that exceeded expectations.

“Fiscal third-quarter revenue increased 37% year over year to $481 million, with subscription and professional services sales growing 38% and 9%, respectively,” Morningstar equity analyst Malik Ahmed Khan says about Okta. “The firm’s top line eclipsed our estimate of $464 million, primarily due to the outperformance on the subscription line.”

Splunk likewise saw impressive revenue growth of 40% to $930 million year over year, which beat the FactSet consensus estimate of $847 million. “Most of this outperformance can be ascribed to Splunk’s term license sales ticking up nicely, growing 54% year over year,” Khan says.

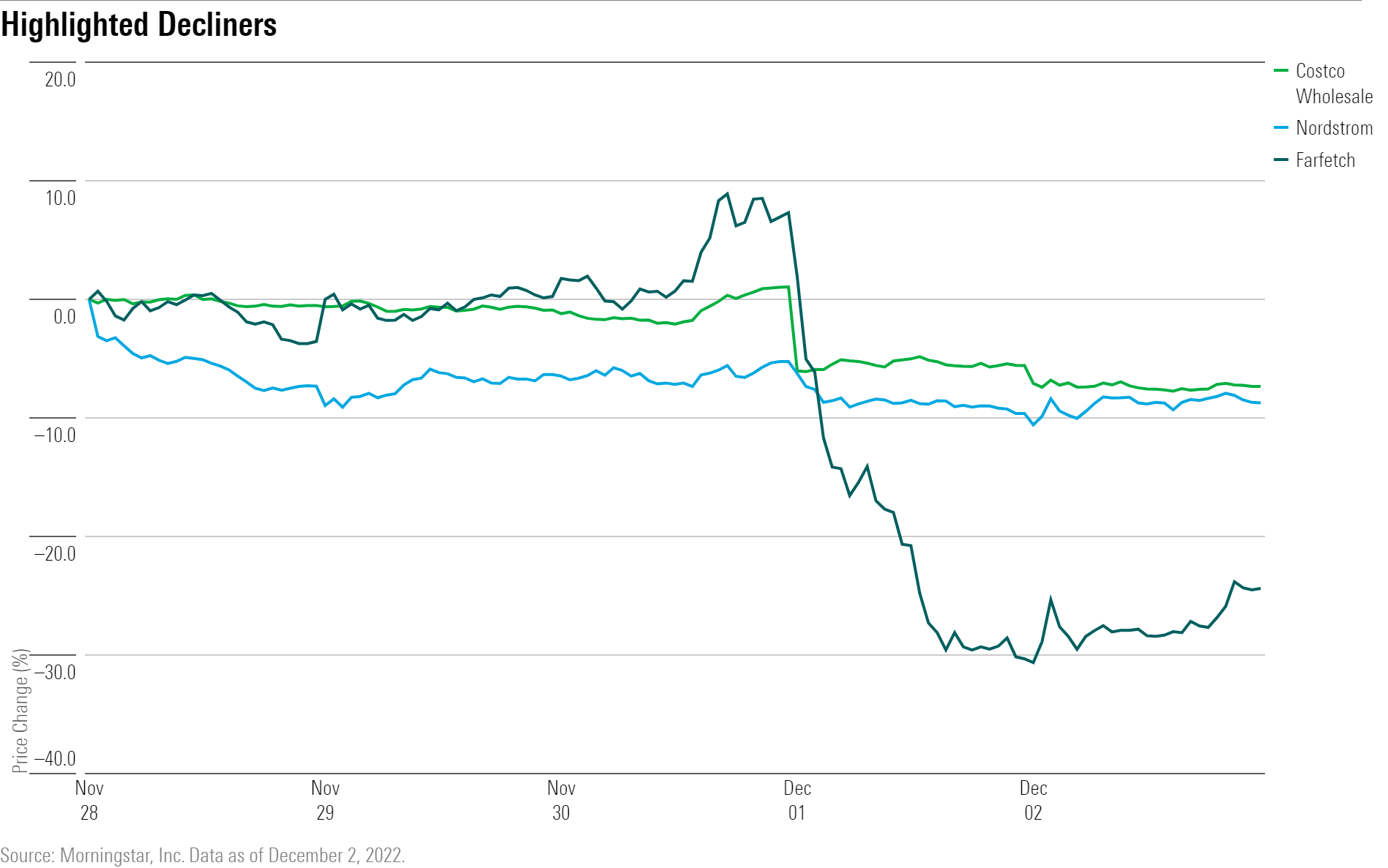

What Stocks Are Down?

Farfetch (FTCH) tumbled after the e-commerce fashion platform released a 2025 gross merchandise value target of $10 billion during its capital markets day on Dec. 1. “The forecast seems conservative and implies a substantial slowdown for main marketplace business GMV growth to 8%-10% until 2025 versus 38% compounded annual growth over the last three years and 45% over the last five years and in line with the online luxury market,” says Morningstar senior equity analyst Jelena Sokolova.

She also says that “we expect to reduce our fair value estimate for no-moat Farfetch by a mid- to high-single-digit percent.” Farfetch has a Morningstar fair value estimate of $18.70 per share. Clothing retailer Nordstrom (JWN) stock also declined during the week.

Costco Wholesale, the members-only wholesale retailer, slid after it reported November sales of $19.17 billion, up 5.7% from a year ago. Sales growth slowed compared to year-over-year rates from October, when sales rose 7.7%, and September, up 10.1%. Costco is set to report fiscal 2023 first-quarter results on Dec. 8.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UYSRGR6ZLJFWXDECADZPSR7BJU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MLKHO4HEDJETLPBTREPIAMGQBE.png)