How Fund Managers Are Handling Uncertainty Around the Debt Ceiling

Managers share how they are preparing for the pending outcome of debt-ceiling negotiations.

Washington’s budgetary brawl over allowing the United States to borrow more money has spilled onto Wall Street, worrying markets in a manner not seen since 2011. Colleagues at Morningstar have weighed in on whether investors should worry and what happens if the debt ceiling isn’t raised before the so-called X-date, or day the U.S. will no longer be able to fulfill all its financial obligations, which Treasury Secretary Janet Yellen has identified as June 1.

But there is a more subtle risk hiding in plain sight. It is one thing to not receive timely payments from Treasuries held in an investment account. It is quite another for a T-bill at maturity not to return its principal. Even if it eventually did, the lag would create uncertainty and real opportunity costs.

Morningstar asked portfolio managers of both active and passive strategies how they are navigating such risks. Their answers below show they are preparing as best they can to minimize the potential disruption and help investors meet their goals.

What Happens if the U.S. Debt Ceiling Isn’t Raised?

Some managers believe investors may rush to buy more U.S. Treasury debt, potentially pushing prices higher. Others say U.S. Treasury prices could go lower and other government-backed securities, such as agency mortgages, could be negatively affected, too.

Still, history tells us that investors reach for U.S.-backed debt in times of market stress. In 2011′s debt-ceiling crisis, our colleagues note, some market watchers thought S&P’s downgrade of the U.S. sovereign debt rating would raise borrowing costs. However, U.S. Treasuries rallied over the following 12 months.

So, while it is difficult to know what the future holds, each manager we surveyed still believes it is highly unlikely that the U.S. government will default on its obligations. However, it’s helpful to understand what’s at stake for investors.

- Interest and maturity payments could be delayed. Many managers noted the Treasury could prioritize bond payments over Social Security, but it has not publicly confirmed this and there are questions about whether it could.

- In the case of delayed payments, T-bill investors may not be made whole on time for any accrued interest from delayed maturity payments (T-bills are issued at a discount price and mature at par). Some managers said that T-bills are an important component of individual and corporate cash management strategies, so any payment delays could have cascading effects across the economy. Still, Pimco stated that if this were to happen, “the Federal Reserve may try to step in, buying in-default T-bills and swapping good collateral for bad. However, the Fed would not be able to ameliorate the large fiscal cliff if Treasury stops making Social Security and other payments, which amount to over $100 billion per month.” So, there are many unknowns.

Read more about this in DBRS Morningstar’s “What Happens if the Debt Ceiling Isn’t Raised?”

Active Manager Responses

1. How are active fixed-income managers handling heightened uncertainty around the debt ceiling?

Active managers are preparing to handle this uncertainty in three main ways: investor education, investment operations, and portfolio management.

While we, along with each asset manager we surveyed, believe U.S. elected officials will reach a deal on the debt ceiling before the X-date, it’s prudent for firms to prepare for the worst-case scenarios and put these scenarios into context for their clients.

2. Why are investment managers focused on investment operations?

Asset managers must constantly monitor their investment mandates, and some client portfolios may not allow securities in default. Thus, firms must be prepared to handle portfolio accounting, processing, and trading of missed coupon and principal payments on any securities issued by the U.S. Treasury. Additionally, they are assessing any potential downgrades from major credit rating agencies on U.S. Treasury and agency issuer and issue ratings. For example, TCW is running downgrade scenarios on their portfolios and determining ahead of time the best way to handle this if any of their clients face guideline issues if the payments are missed. Fitch and DBRS Morningstar put the U.S. AAA rating on watch for a potential downgrade on May 24 and May 25, respectively.

3. Will there be issues with the technology used in fund managers’ risk management or trading systems?

Given that this has never happened before, there is some degree of uncertainty. However, this isn’t the first time managers have been forced to contemplate a U.S. Treasury default, and many large asset managers reported they have contingency plans in place to minimize disruptions.

Some managers pointed to 2011 as a test run. The U.S. Treasury did not default then, but it got so close that S&P downgraded its credit rating of the U.S. government to AA with a negative outlook. Managers have had over a decade to prepare for a nightmare scenario, so one would think market participants are ready, but could a few managers who are unprepared cause market issues? Perhaps.

4. Are managers making changes to their portfolios?

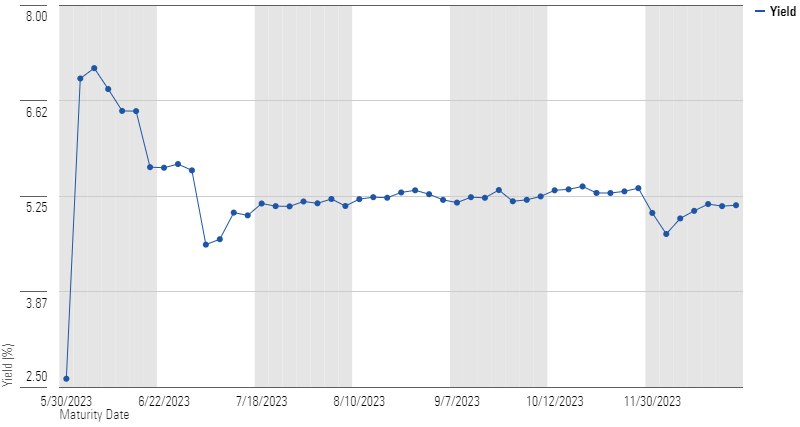

For the most part, yes. While managers believe it is unlikely the U.S. Treasury will default, they are in the business of managing risk and many are prudently preparing for the worst by avoiding U.S. Treasury bills set to mature around Treasury Secretary Yellen’s publicly projected X-date of June 1. As a result, June T-bill yields have spiked.

Yields of U.S. T-Bills Maturing in the Next Year

Many managers don’t think they are being compensated for the risks of holding these June-maturing securities. For example, TCW noted on May 25 that the 50 to 100 extra basis points on June T-bill maturities compared with May and July amounts to less than 2 to 6 additional basis points on an annualized basis. The TCW team behind Metropolitan West Total Return Bond MWTRX, which has a Morningstar Medalist Rating of Gold, stated they are eschewing June-maturing Treasury bills for “overnight repo [repurchase agreements] where we can get high yields (over 5%) and high liquidity and eliminate the risk of default as well as buying October 2023 and later maturity T-bills that offer similar high yields, and likely avoid the issues surrounding the debt-ceiling negotiations and potential for a default.”

Still, top managers are always on the lookout for opportunities with market dislocations. Basis points matter in fixed-income management, so if yields continue to climb, it’d be unsurprising to see some managers see this risk/reward profile change.

While all believe a default is still highly unlikely, each manager we surveyed expects a deal at the last moment and is preparing for further market volatility. The team behind Silver-rated Loomis Sayles Bond LSBDX says the market is in a strange period with how difficult it is to evaluate the reach of Federal Reserve monetary policy to all parts of the economy. Rising interest rates have created cracks in the banking system, and further market volatility is likely. Thus, the Loomis team is maintaining ample portfolio liquidity to take advantage of any attractive yields and spreads resulting in the next few months.

5. Comments on the uncertainty impacting repurchase agreements, swaps, and credit default swap index markets?

Managers believe the Fed will use its extensive toolbox to ensure these markets function properly. For example, repurchase-agreement markets are functioning fine now, but if there were issues, the Fed could backstop these markets using the standard repurchase-agreement facility.

While market volatility could sharply increase, managers do not believe there would be issues for short-term debt markets, swaps, or other derivatives.

Passive Manager Responses

1. How much exposure do passive funds have to short-term Treasuries?

Most passive bond funds do not have a large allocation to June-maturing Treasuries, even for Treasury-focused, ultrashort index funds. Most short-term bond indexes target securities with effective maturities of more than one year, while many ultrashort indexes cut off securities with less than one to three months remaining to maturity at rebalancing. Nonetheless, Treasuries close to maturity can still show up in an index fund portfolio. The exhibit below displays a few notable passive bond funds with sizable exposures to Treasuries maturing by the end of June.

Ultrashort bond strategies populate the list, but there are other fund types to be worried about. Invesco BulletShares 2023 High Yield Corporate Bond ETF BSJN, a defined-maturity exchange-traded fund, parked nearly 20% of its assets in T-bills maturing on June 22, as of May 25, after some of its high-yield corporate bonds matured.

Notable Passive Bond Funds With High Exposures to Treasuries Maturing by June 30, 2023

Bond funds are not the only ones with substantial allocations to Treasuries, however. Many options and futures-based strategies use Treasuries as collateral or to manage cash—some of which may have maturities near the X-date.

2. What would passive fund managers do if Treasuries default?

Modest exposure to close-to-maturity Treasuries can still cause damage to portfolios. Passive funds track the performance of their indexes, which imposes limitations that active managers do not face. Passive managers we surveyed did not rule out the possibility of deviating from their index to protect investors in case of a catastrophic event such as a U.S. Treasury default, though there are other steps they could take.

Passive fixed-income managers often employ stratified sampling to approximate index performance without holding all constituent securities. Sampling gives more leeway to tracking larger indexes, but opportunities for sampling are limited in smaller indexes with few securities for managers to choose from.

Most managers emphasized the importance of working with index providers to resolve potential complications. During extraordinary events, index providers have incentive to maintain index investability by allowing for special exceptions, such as occurred in March 2020. During that volatile period, asset managers worked with index providers to push back rebalancing dates until after the March 2020 volatility subsided.

In case of an actual default, index providers could choose to keep the defaulted securities in the index instead of removing them, which would normally be the case. This allows passive funds to reclaim the recovery value of missed payments without deviating from the index.

Conclusion

Market volatility is a normal part of investing and market reactions are hard to predict. Still, should the X-date pass without resolution, investors can rest assured that managers, both active and passive, have their best interests in mind. Treasury holders will almost certainly eventually be made whole, and the Treasury, the Federal Reserve, and other institutions will have countermoves prepared should the X-date come to pass.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5PEUA7XEBNFN5NFCFQ73HT5XIM.png)