Morningstar® ByAllAccounts®

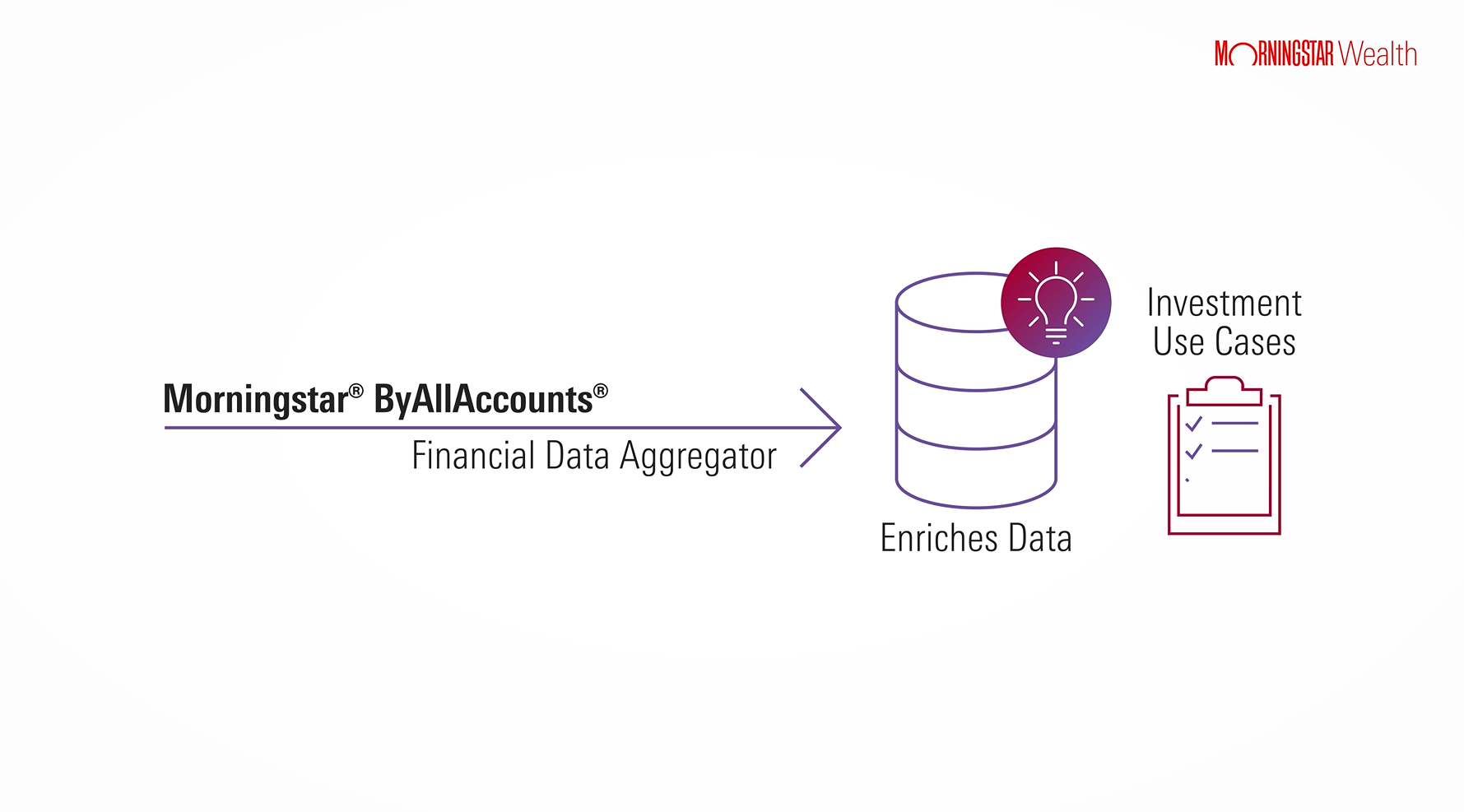

Transform financial data into insight through account aggregation.

Get the data, flexibility, and confidence you need with ByAllAccounts—the data aggregator built specifically for investment use cases. We aggregate raw data from over 15,000 sources. Because we are agnostic to formats, we choose the best quality and most complete data from a diverse wealth of sources to provide visibility into clients’ holdings, spending habits, and cash flows.

Built to serve the investment industry

Wealth Management Firms

Turn investor data into your most valuable asset

Fintechs & Startups

Inspire your next great product innovation

Resellers & Redistributors

Power your experience with industry-leading tools

Financial Data Providers

Seamlessly connect your data to your customers

Easily Unlock Deep Portfolio Insights with Next-Level Enrichment

Our new premium portfolio analytics feature enables you to easily and cost effectively enrich aggregated investment holdings with fund and equity attributes—sourced from Morningstar Licensed Data.

Fund and stock attributes include: regional breakdowns, asset allocations, equity and fixed-income sector exposure, equity and fixed-income style boxes.

Streamline proposal generation, power risk analytics, and simplify rebalancing, financial planning, and other portfolio operations.

Click image to enlarge and view animation

Exceptional data for exceptional outcomes

Make superior decisions with aggregated data standardized into a single, consistent model. Based on industry standards and utilizing Morningstar’s proprietary identifiers, we transform disparate data into its most usable form.

Use-case-driven, highly enriched data: how you need it, where you need it.

ByAllAccounts uses artificial intelligence and other advanced, proprietary systems to quickly deliver client account data to performance reporting, portfolio analytics, portfolio rebalancing, financial planning, financial wellness, and trade compliance management solutions, saving you time and operational costs.

More complete, more consistent data

Our patented process makes sense of insufficient data sources and bridges gaps with Morningstar data, delivering enriched firm-level feeds to a network of over 6,000 advisory firms, 70+ redistribution partners, and 50+ platform integrators.

How Morningstar ByAllAccounts Can Help You

Decades-long experience providing quality data.

Higher-quality Data

Our proprietary data enrichment engine is investment use-case-driven, and combines machine learning with knowledge-based processes.

Increased Data Accuracy

Our cutting-edge hybrid model combines rules-based methods and machine learning for superior outcomes.

Industry-Leading Security Master

Market Monitoring

Precise Data for Reporting

Access transaction-level detail of clients’ cash flows to accurately calculate their performance returns.

Security Highly Prioritized

All sensitive data is transmitted and stored encrypted, even when communication is between components of the service itself.

U.S. Open Banking

Morningstar ByAllAccounts is your essential partner for open banking. As an active participant in the U.S. open banking ecosystem, we are committed to empowering advisors and their investors with high-quality financial data tailored to investment use cases.

Make Aggregated Data Your Most Valuable Asset

Download our white paper to discover the four factors of superior aggregation for enterprise-level investment use cases:

· Deepest data sourcing

· Highest-quality data

· Seamless integration to the Morningstar ecosystem

· Long-term commitment to the investment industry

Resources

Guide

Data Aggregation 101

Solution Brief

Holistic Reporting for Multi-Custodied Advisors

Solution Brief

Financial Planning

Solution Brief

Portfolio Analysis

Solution Brief

Trade Compliance

Solution Brief

Performance Reporting

Solution Brief

Financial Wellness

eBook

Make-or-Break Decision

eBook

Personalization at Scale

Data Sheet

Data Aggregation

Product Sheet

Premium Portfolio Analytics

Product Sheet

Connect

Product Sheet

AccountView

Product Sheet

Data Enrichment

Case Study

Rowling and Associates

Case Study

Asset Vantage

Product Video

An Overview of ByAllAccounts

Product Video